This post is sponsored by RBC. All expressed opinions and experiences are my own.

I confess. There have been some years where we have completely blown our holiday shopping budget at Christmas, shopping for gifts. Whether it’s lack of time, lack of planning, or emotional shopping, there have been years where my husband Mike and I have blown it…big time.

In the moment we think, “we’ll deal with it later”, but when later comes in January and you have to face the bills you’ve racked up, it feels awful. Not to mention, there is a ripple effect for months.

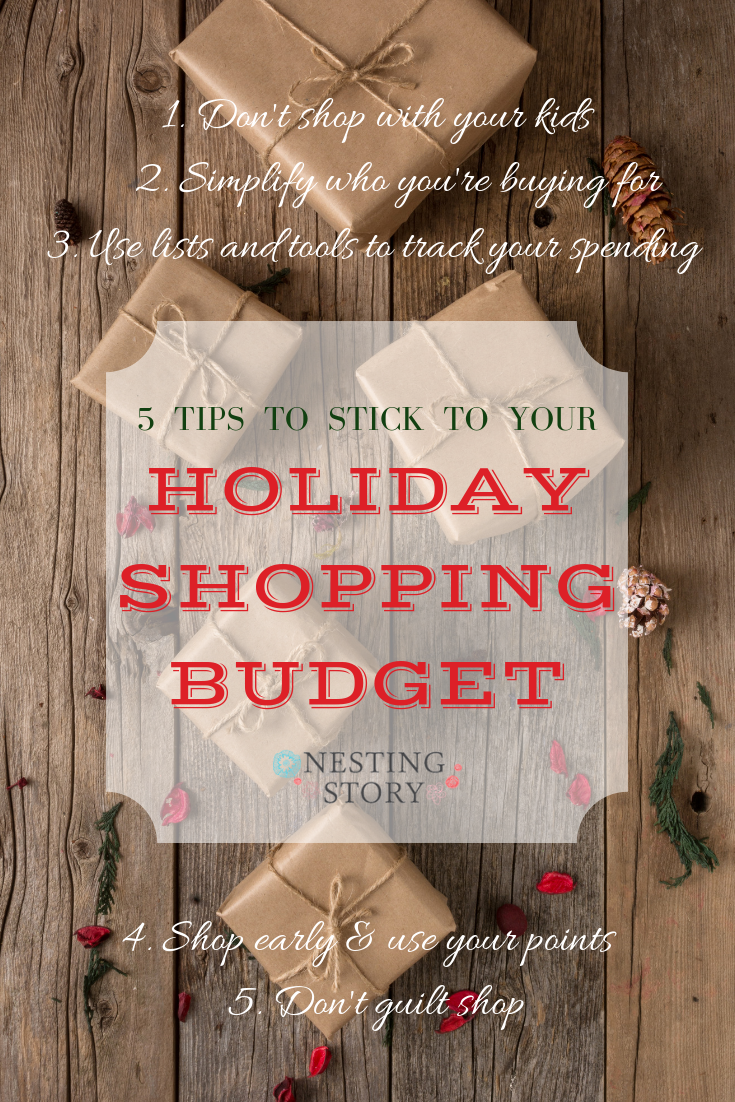

Finally, we’ve gotten to the bottom of this out-of-control spending and have learned not only why we were doing this to ourselves, but also how to avoid making this same mistake again. Here are some real-life tips to help you stay on track with your holiday spending.

1. Don’t shop with your kids

Whether it’s online shopping at home, or in-store, avoid shopping with your kids at all costs. They can distract you and rush you into making a purchase that you really didn’t think through properly. I think the biggest challenge with holiday shopping while your kids tag along is the pestering.

Oh the pestering!

Fun fact… as a young child, I pestered so much that my parents banned me from stores for two years. TWO YEARS! This was way before online shopping, so how my mother followed through with this is beyond me. But my hat’s off to her, because that gave her some serious street cred among my siblings and me.

So, how exactly do you shop without your kids? Do your online shopping while your kids are napping, in school or in bed for the night.

Shopping in-store can be a little trickier. Hiring a babysitter for a few hours, and heading out the door with a clear list and plan is worth every penny.

Don’t have the luxury of being able to get a sitter? Try doing a swap with a neighbour or a friend. See if you can each watch the other’s kids while you get your holiday shopping done.

2. Simplify who you are buying for

At what point do you stop buying for all of your grown siblings and their kids? It’s worth the conversation with family members. You never know, everyone might be thinking the same thing, but everyone is too nervous to bring it up. Start setting some boundaries, and drawing the line.

Would switching to secret Santa for all of the relatives make more sense? What about capping the budget? We’ve slowed down the spending with our extended family and it has made a huge difference for our budget and all of the work that goes into figuring out what to get.

Replace that tradition with something new. We have started to host my brother and his family each Christmas for brunch and have a potluck style meal. This new tradition gives us something else to look forward to and plan.

3. Use lists and tools to track your spending.

Lists are imperative. Walking around a mall aimlessly without a list can do some major damage to your set budget. Have a plan and stick to it!

Our family uses RBC’s NOMI to help track our spending. Mike and I split up our spending and will often tackle our lists at separate times. NOMI helps us co-ordinate our spending by tracking gift buying while also monitoring our spending in other areas to compensate and make sure we aren’t going overboard.

Gift buying isn’t the only thing that puts a strain on your budget during the holidays. All of the entertaining and outings ramp up and can easily get out of hand. To keep on eye on this spending, we also use NOMI to track everything from our grocery bills to how much our family is spending on entertainment.

4. Shop early and use your points.

I grew up in a house that always decorated for Christmas and did our holiday shopping well into December. Two of my siblings’ birthdays are in late November, so it was kind of an unspoken rule in my home.

But as an adult, and then as a mom, I started to realize that this wasn’t a rule that I had to follow and it was actually adding to my stress.

Over the past couple of years, I’ve begun my shopping in November and have completed everything by the second week of December. This has been a game-changer for my stress level and has helped me stick to a holiday shopping budget, because I’m not rushing around.

Another thing I do is redeem my RBC Rewards points for gift cards including Amazon, Starbucks and Tim Hortons that we give to our kids’ teachers (teachers love gift cards), Home Depot and Bass Pro Shops for my brother-in-law (he loves anything DIY and sporty), and Cineplex for my mom (she loves movies).

5. Don’t guilt shop.

This has been a big lesson for Mike and I, and we’ve done it more than once.

When our son Holden was two, and our daughter Beau was a baby, we went completely overboard with the gifts.

You see, our son Holden had a language delay and Sensory Processing Disorder, which was so challenging during those first few years. We were constantly battling feelings of defeat, because we didn’t know exactly how to help him, and guilt, because so often life seemed so very hard for him.

Looking back, we compensated what we were feeling with buying him lots of toys. Although Holden is now nine-years-old, and thriving, we still battle this feeling of wanting to spoil him because of the trauma we felt as parents during those years.

We have even guilt shopped out of nowhere. Every few years we spend Christmas in Florida, and the last time we were there, we ran out to the store and bought a bunch of extra toys for our kids because we were worried they didn’t have enough to open on Christmas morning.

We were so wrong!

They played with those bonus guilt toys for a few minutes before asking us to play with them on the beach.

All they wanted was us.

Disclosure: This post was sponsored by RBC. While compensation was provided, all opinions expressed herein are those of the author and are not necessarily indicative of the opinions of RBC.